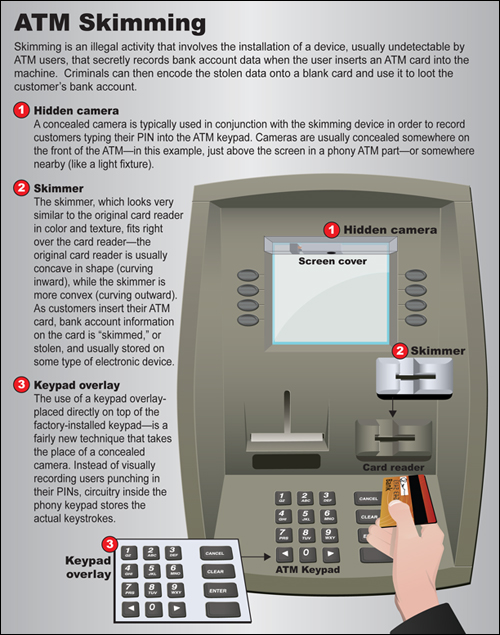

ATM skimming is a fraud scam when criminals try to capture Debit card numbers by attaching an illegal card-reading device (skimmer) on a legitimate ATM or POS (Point of Sale) terminal. Hidden cameras or a keypad overlay are usually used in conjunction with skimming devices so they can capture your PIN as well. These criminals can then use your card number and PIN to create duplicate cards and basically wipe out your account.

Criminals have also been known to install skimming devices at gas pumps, stores, and other locations. To avoid detection, they often install the devices and remove them after a short period of time. Fraudulent transactions using information from skimmed cards may take days, weeks or months to occur.

Tips to help avoid becoming a victim of a Skimming device:

- Inspect the ATM before you use it. Check for any tampering and wiggle everything. Gently tug the card reader. There should be no loose parts. Be alert for card readers that do not match the color and style of the ATM or have sticky residue and tape around the card reader and PIN keypad. If something looks suspicious or out of place don't use the ATM and report it right away.

- Look for tiny cameras loosely installed over pin pad. Inspect overhead light fixtures and envelope/brochure holders on the ATM for very small holes where a micro (pinpoint) camera could be installed.

- Always cover the PIN pad with your hand. When entering your PIN on any device, shield your PIN from view of hidden cameras or people watching.

- Check your accounts frequently. Members can use Mobile or Online Banking to check balances and view transactions anytime. You can also set up free account alerts to help notify you of transactions hitting your account. If you spot fraud, report it to us immediately.

- Change Your PIN periodically.

- Use secure or familiar ATM machines. ATMs located in well lit, high traffic areas, and have video surveillance or ATMs that are located inside a branch lobby are less likely to be tampered with. It’s a good habit to use the same ATM so if you notice something unusual about the ATM you can report it.

Tips When Using a Fuel Pump

Fuel pump skimmers are usually attached in the internal wiring of the machine and aren’t visible to the customer. The skimming devices store data to be downloaded or wirelessly transferred later.

- Choose a fuel pump that is closer to the store and in direct view of the attendant. These pumps are less likely to be targets for skimmers.

- Run your debit card as a credit card. If that’s not an option, cover the keypad when you enter your PIN.

- Consider paying inside with the attendant, not outside at the pump.

Card skimming has affected financial institutions everywhere. Skimming devices can come in many forms and are difficult to detect. To protect yourself from ATM skimmers, please take extra caution when using ATMs. If you suspect that you’re a victim of ATM skimming, please notify us right away.

If you have any questions, speak to a Member Services Representative at 866.4ILWUCU.